Cold and dreary day here in the city… after bouncing around and threatening to even higher, the NYMEX ultimately settled about 6 cents down in the front month. Prices for later months are all nearly unchanged.

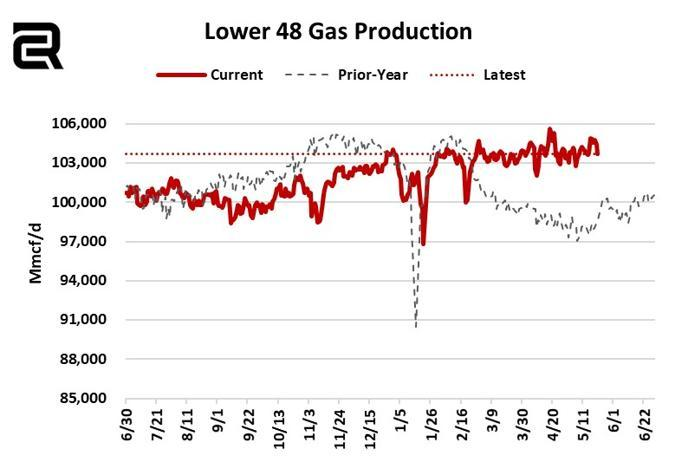

Production in the lower 48 states continues to fluctuate slightly day to day, but overall remains quite strong in the face of increasing demand for LNG and electricity. Current production levels are about 103.7 Bcf/d according to Criterion, and Constellation reporting the year-to-date so far to be 104.2 Bcf/d. Compare this to the 101.6 Bcf/d output at this time last year, and its easy to see that the market has a relatively comfortable amount of supply, though more is needed to meet future demand.

Right now, one wildcard is crude prices. The WTI crawled up from the high $50s US/barrel to the low $60s US/barrel, but there is still the risk of crude producers scaling back production at this price level. In return, less associated natural gas production. The price of natural gas liquids like propane and butane does help offset that pressure, but not enough to be significant.

Natural gas production could increase, but is currently shackled to crude in a way. Many eyes will be on the WTI as summer approaches.