To everyone closely following gas markets, congratulations on simply getting through this week. In times like these, it’s important to remember that the fundamentals can shift, but the financials often move faster. At the beginning of winter, we mentioned that this winter’s temperature-prediction models are having a hard time catching cold in the mid to short-term, and the result of this issue is here. The NYMEX market wasn’t ready for this news, and while it fights to catch up, the momentum snowballs as traders cover their short positions and geopolitical uncertainty spreads at the same time.

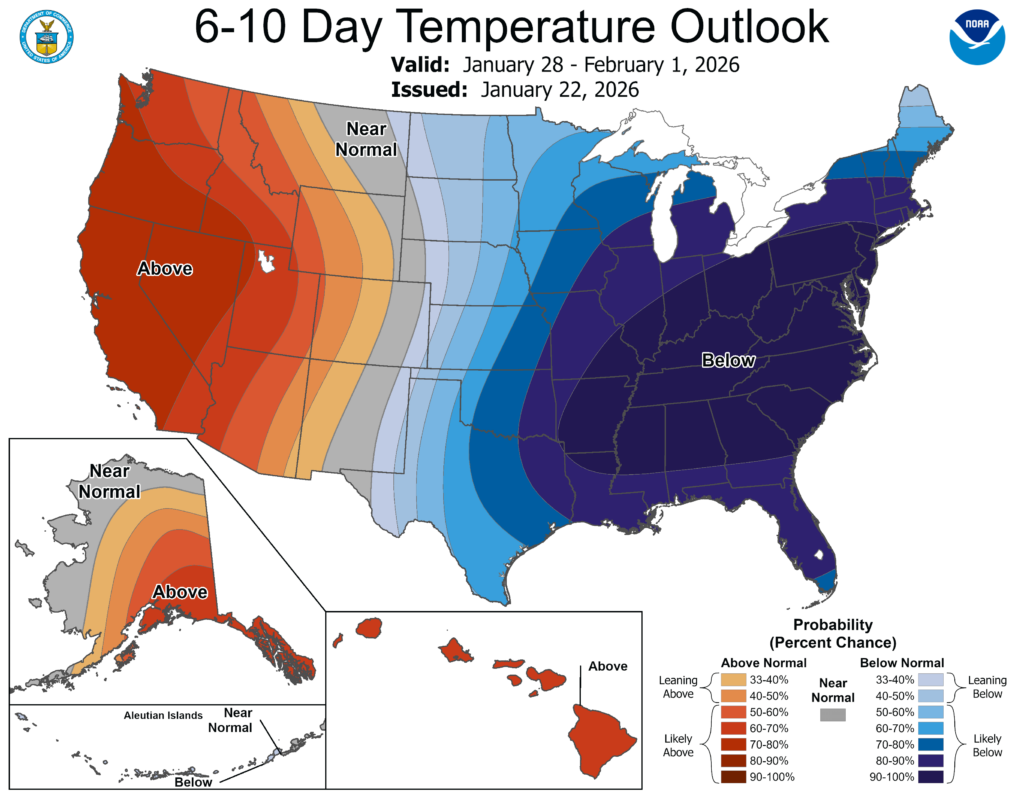

At the time of writing, the February 2026 future contract is trading at $5.38 US/mm. As a reminder, this was $3.18 US/mm a week ago, before the American long weekend. Meteorologists are saying that this cold snap is not over-hyped, a huge portion of the US and Canada can expect extreme cold and weather (even those living as south as Texas should be prepared for ice).

Canadian production has been hovering at multi-year highs, but American production is feeling the effect of freeze-offs, surely with more to come. Currently, the potential loss is estimated to be about 65 Bcf in supply. Canadian gas exports are at new seasonal highs as US heating demand surges, and with less stateside supply available, they look to Canada. Dawn storage in particular will be relied on to keep the Northeastern US warm during this period.

Ontario temperatures are expected to hit the low on Saturday, then steadily climb back up to near-normal by the first week of February. Stay safe and warm this weekend.