The gas market and its participants continue to weather winter storm Fern after another particularly volatile day for prices. On its last day of trading, the NYMEX February 2026 contract hit a low of $5.90, a high of $7.83, and ended up settling at $7.46, about 50 cents up since yesterday. That’s a huge range even for gas, but unsurprising as open interest is very low.

In all, freeze-offs in the Northeastern US continue (production currently being near a two-year low), but have eased some since yesterday and thus so have Canadian exports to the US. Dawn spot prices recovered since yesterday’s multi-year high of $90 C/GJ, but are still in the relatively high $10+ C/GJ range, Dawn is not out of the woods. Last piece of news for Dawn is that the GLGT pipeline reported a Force Majeure for flows eastbound of Emerson, which would decrease supply by ~171,000 GJs/d until the end of February.

Expectations for tomorrow’s storage report is for a withdrawal of -230 Bcf to -250 Bcf, with likely one more massive withdrawal to follow in the next report. Storage is quickly turning into a bullish factor for prices as inventories will surely dip below the 5-year average.

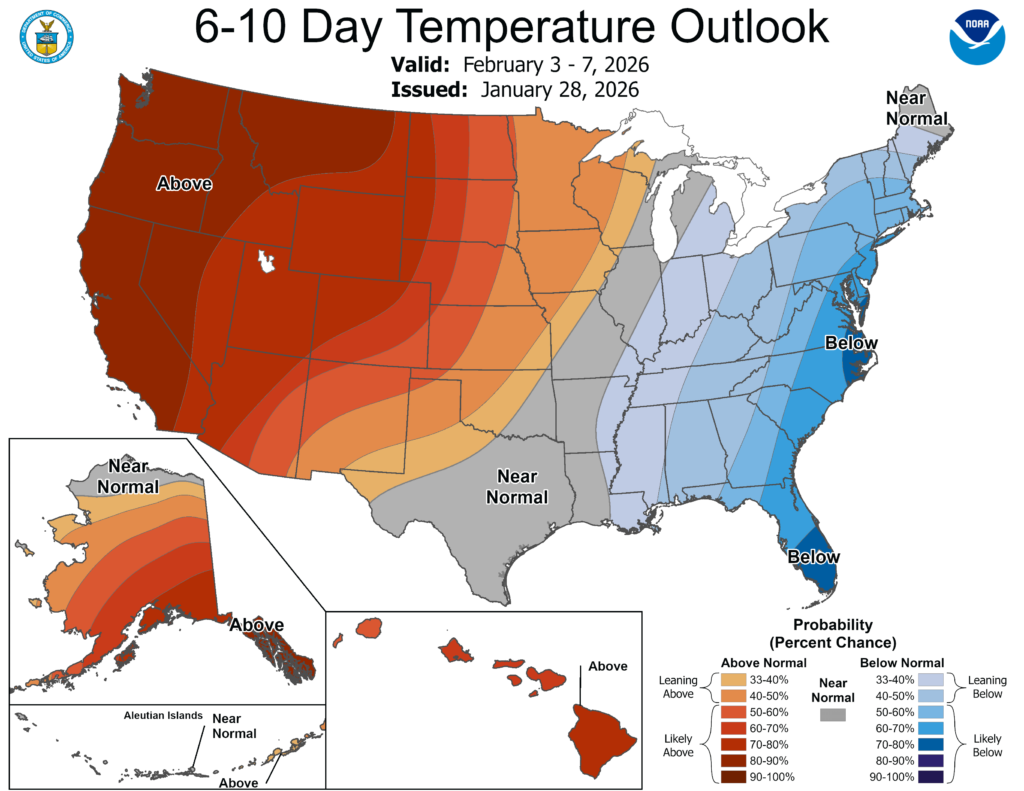

Looking ahead, meteorologists are expecting next week to offer a bit of a break for the Northeastern US and Canada from the cold, but are quite confident that it will return the following week. In the mean time, NOAA’s 6-10 day temperature outlook shows how temperatures are likely warming up to near normal for Southern Ontario. Stay tuned.