Natural gas markets were mixed today as the front two months (Jan-26 and Feb-26) dropped, but the next 10 months posted small gains. The NYMEX front month fell $0.08 USD/MMBtu or 1.6% to settle at $4.84 USD/MMBtu. Earlier in the session, the contract reached as high as $4.98 USD/MMBtu before oversupply concerns caused traders to discount the price.

Markets remain thinly balanced in a high production, high supply dynamic with a massive impending demand surge. Forecasts all point to colder than normal, but how cold is the question? Daily revisions to forecasts are causing markets to whipsaw as traders adjust pricing based on the latest weather data.

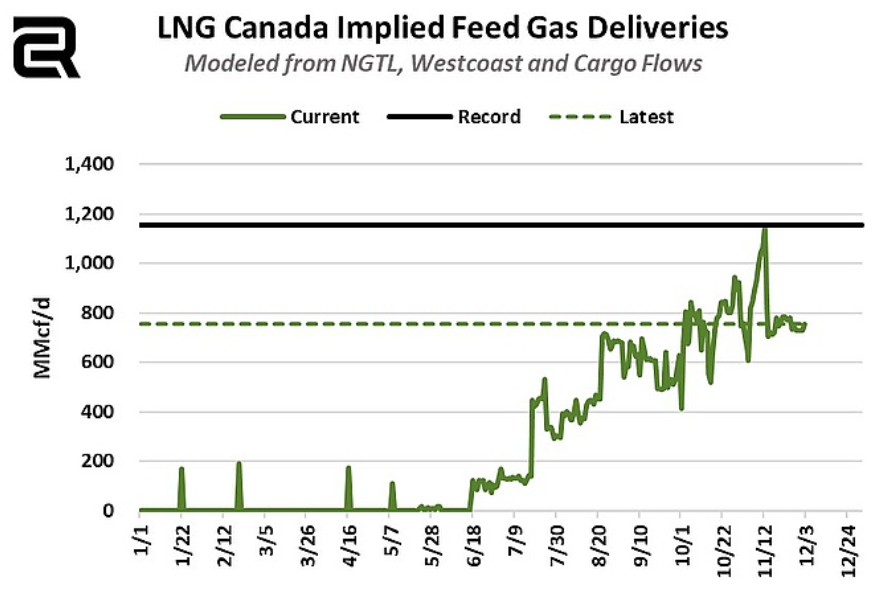

In BC, LNG Canada announced flaring associated with the cooldown of an LNG carrier. The report is expected to signify the restart of Train 2 flows. Shell had previously disclosed that the plant would be fully operational by the end of the year, but flows have yet to surpass the 1.2 bcf/d mark. Flows consistently holding over the 1 bcf/d mark would provide further bullish support to Canadian gas prices. (PB)

Source: Criterion – Canadian Fundamental Natural Gas Report